The allure of generating income without the traditional 9-to-5 grind is a powerful one, and the question of whether it's truly possible is met with both skepticism and eager anticipation. The short answer is yes, it is possible, but it's crucial to approach this goal with realistic expectations, a robust understanding of risk, and a willingness to learn continuously. It's not about getting rich quick; it's about building a sustainable income stream through strategic investments and leveraging technological advancements.

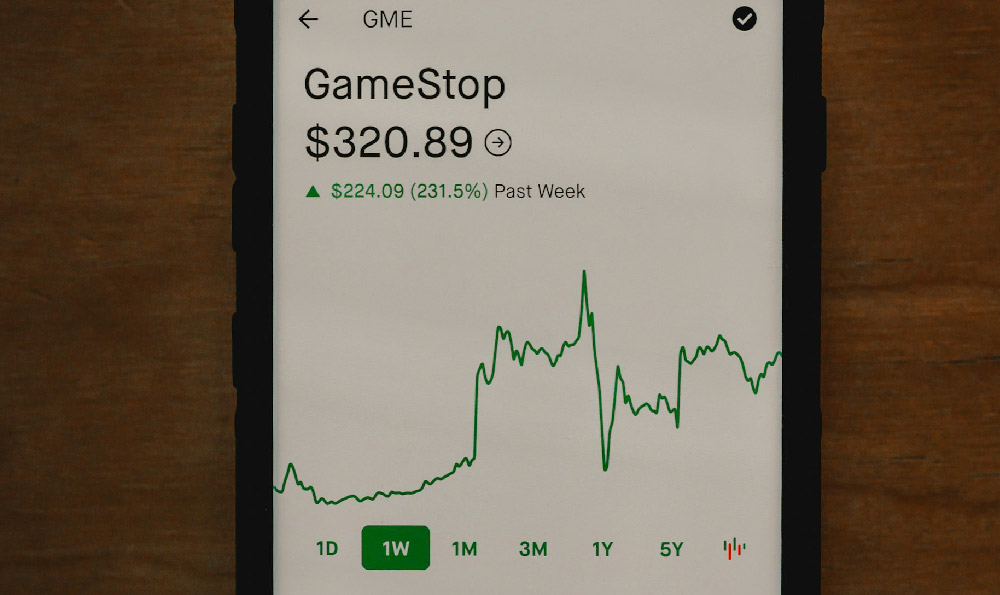

The crypto market, with its inherent volatility and potential for high returns, is often cited as a prime example. However, diving into crypto without a solid foundation is akin to gambling. It requires a disciplined approach, a keen eye for market trends, and a deep understanding of the underlying technology.

One avenue for generating income in the crypto space is through long-term investing in established cryptocurrencies like Bitcoin and Ethereum. This involves researching the fundamentals of these projects, understanding their use cases, and holding onto them for the long haul, weathering the inevitable market fluctuations. It's crucial to diversify your portfolio, allocating only a portion of your capital to crypto and spreading it across different assets to mitigate risk. Don't put all your eggs in one basket, especially in a volatile market like crypto.

Another method is crypto staking, where you earn rewards for holding and validating transactions on a particular blockchain. Many cryptocurrencies use a "proof-of-stake" consensus mechanism, which allows you to earn passive income by staking your coins. The returns can vary depending on the cryptocurrency and the staking platform, but it's generally a less risky option than active trading. However, be mindful of the lock-up periods and potential inflation rates of the token.

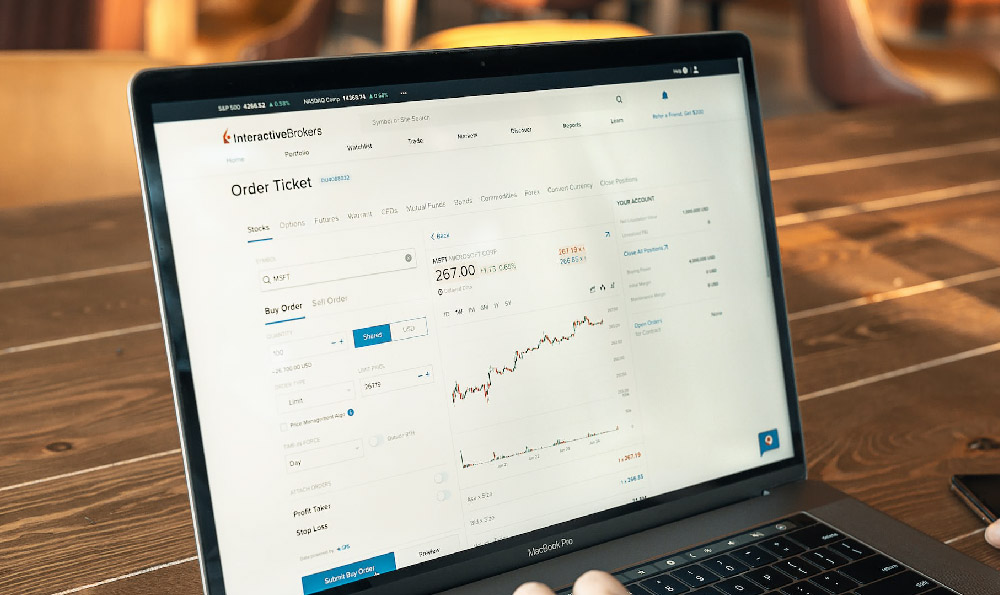

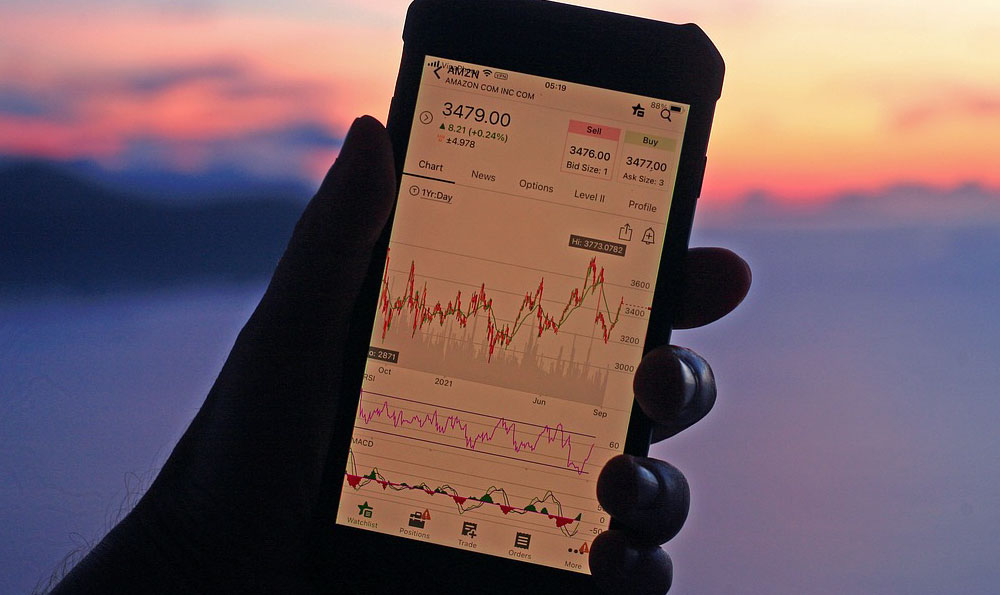

Trading cryptocurrencies is another, albeit riskier, option. This involves buying and selling cryptocurrencies based on short-term market fluctuations. Success in crypto trading requires technical analysis skills, the ability to read charts, identify patterns, and execute trades quickly. It also demands emotional control, as the market can be highly unpredictable. A well-defined trading strategy with strict stop-loss orders is essential to protect your capital. Avoid trading on leverage unless you fully understand the risks involved, as it can amplify both profits and losses.

Beyond simply buying and holding, decentralized finance (DeFi) offers a plethora of opportunities to earn yield on your crypto assets. Lending platforms allow you to lend out your crypto to borrowers and earn interest. Yield farming involves providing liquidity to decentralized exchanges and earning rewards in the form of governance tokens. While these opportunities can be lucrative, they also come with risks such as smart contract vulnerabilities and impermanent loss. Thoroughly research any DeFi protocol before investing and understand the associated risks.

Mining cryptocurrencies is another way to potentially generate income, although it requires significant upfront investment in hardware and electricity. Mining involves using computing power to solve complex cryptographic puzzles and validate transactions on the blockchain. While it can be profitable, it's becoming increasingly competitive, and the barrier to entry is high. Consider factors such as electricity costs, hardware depreciation, and the difficulty of the mining algorithm before investing in mining equipment.

While focusing on crypto, it's important to remember broader financial principles. Building wealth requires a multi-faceted approach. Investing in traditional assets like stocks, bonds, and real estate can provide a stable foundation for your portfolio. Explore dividend-paying stocks, which provide a steady stream of income without requiring you to sell your assets. Real estate can offer both rental income and potential appreciation, but it also requires significant capital and ongoing maintenance.

Remember the importance of financial literacy. Understand personal finance concepts like budgeting, saving, and debt management. Create a budget to track your income and expenses and identify areas where you can save money. Pay off high-interest debt, such as credit card debt, as quickly as possible. Build an emergency fund to cover unexpected expenses.

The digital age offers unprecedented opportunities for earning income outside of traditional employment. Content creation, freelance work, and online businesses are just a few examples. Building a successful YouTube channel, writing a blog, or offering freelance services can generate income over time. However, these endeavors require dedication, hard work, and a willingness to learn new skills.

No matter which path you choose, remember that generating income without a job requires discipline, patience, and continuous learning. It's not a get-rich-quick scheme, but rather a long-term strategy for building financial independence. Stay informed about market trends, understand the risks involved, and never invest more than you can afford to lose. Consult with a financial advisor to develop a personalized financial plan that aligns with your goals and risk tolerance. With the right approach, achieving financial freedom and escaping the traditional 9-to-5 is a real possibility. It is about creating systems that work for you, instead of you working for the system.