Banks, as the cornerstone of the global financial system, operate on a business model that thrives on intermediation, risk management, and financial innovation. Understanding how banks generate revenue and ultimately profit is crucial for anyone seeking to navigate the complexities of modern finance, whether as an investor, a borrower, or simply an informed citizen. The core of a bank's profitability lies in the difference between the interest it earns on assets, primarily loans, and the interest it pays on liabilities, mainly deposits. This difference is known as the net interest margin (NIM), and it forms the foundation of a bank's income. Let’s delve into the various avenues banks exploit to ensure consistent and burgeoning revenue streams.

The most traditional and arguably the most significant source of revenue for banks is lending. Banks act as intermediaries, collecting deposits from savers and lending that money to borrowers – individuals, businesses, and even governments. The interest rates charged on these loans are significantly higher than the interest rates paid on deposits. The spread between these rates represents the bank’s profit margin on lending activities. Different types of loans contribute varying degrees of profitability. For instance, commercial loans, especially those extended to small and medium-sized enterprises (SMEs), often carry higher interest rates due to the perceived higher risk associated with these borrowers. Mortgages, while typically secured against collateral, also generate substantial revenue due to their large principal amounts and long repayment periods. Consumer loans, such as credit card debt and personal loans, often come with the highest interest rates, making them a lucrative, although potentially riskier, segment of a bank’s lending portfolio. Banks meticulously assess the creditworthiness of borrowers through rigorous underwriting processes to minimize the risk of defaults. They employ sophisticated credit scoring models and conduct thorough financial analysis to determine the appropriate interest rate and loan terms. Managing credit risk effectively is paramount for maintaining a healthy loan portfolio and avoiding substantial losses.

Beyond traditional lending, banks generate revenue through a variety of fee-based services. These fees are often less visible than interest income but contribute significantly to a bank's overall profitability and provide a more stable source of earnings, particularly during periods of low interest rates. Account maintenance fees are charged for the upkeep of checking and savings accounts. While often criticized by consumers, these fees provide a predictable stream of revenue, covering the administrative costs associated with managing customer accounts. Transaction fees are levied for various services, such as wire transfers, ATM withdrawals, and overdraft protection. These fees are especially prevalent in retail banking, where high transaction volumes generate substantial cumulative revenue. Investment management services are another significant revenue generator. Banks offer wealth management, investment advisory, and brokerage services to high-net-worth individuals and institutional clients. They earn fees based on the assets under management (AUM) or through commissions on trading activities. Investment banking activities, such as underwriting securities, advising on mergers and acquisitions (M&A), and facilitating corporate restructurings, represent a highly lucrative area for larger banks. These services generate substantial fees, often amounting to millions of dollars per transaction.

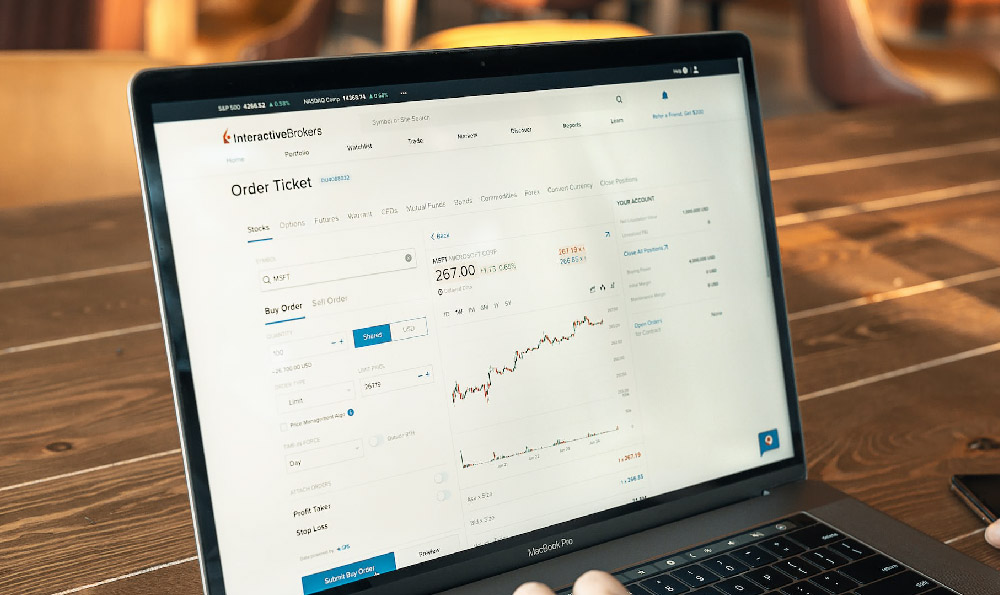

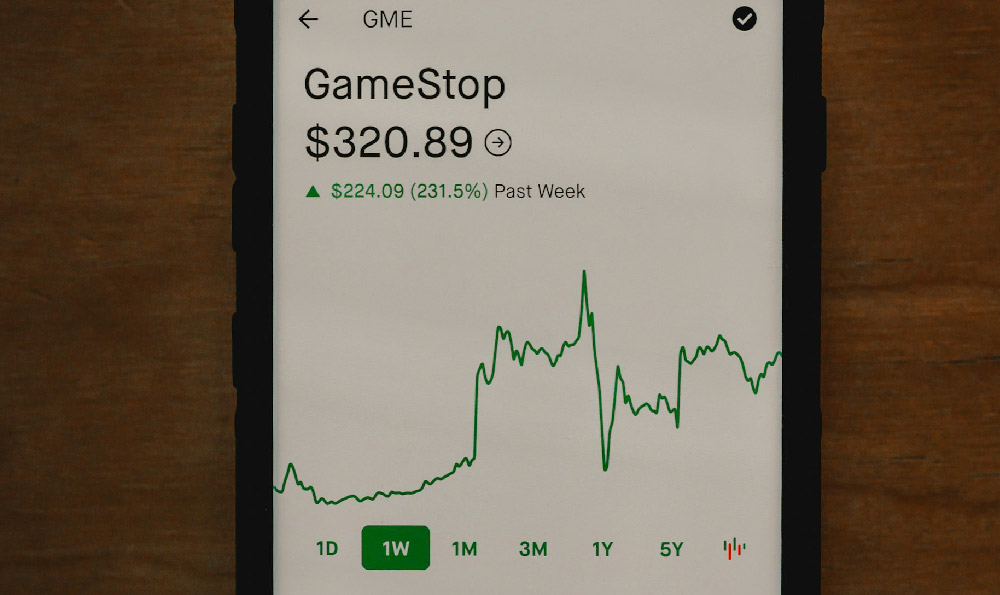

Furthermore, banks profit from trading activities in financial markets. Banks actively participate in the trading of various financial instruments, including stocks, bonds, currencies, and derivatives. They employ skilled traders and sophisticated trading strategies to capitalize on market fluctuations and generate trading profits. Foreign exchange (FX) trading is a significant revenue stream for banks with international operations. They profit from the spread between the buying and selling prices of different currencies, as well as from proprietary trading activities. Fixed income trading, which involves buying and selling government and corporate bonds, is another major source of revenue, particularly for investment banks. Derivatives trading, encompassing instruments like options, futures, and swaps, allows banks to manage risk and generate profits by hedging exposures and speculating on market movements. It is important to note that trading activities are inherently risky and require robust risk management frameworks to prevent substantial losses. Banks employ sophisticated risk models and adhere to strict regulatory requirements to mitigate these risks.

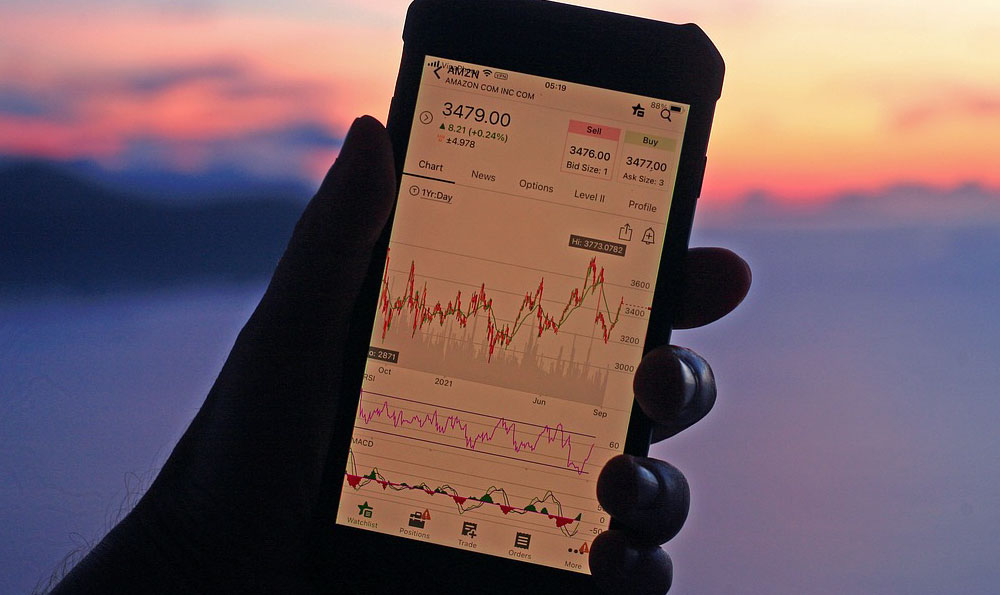

Technological advancements have dramatically reshaped the banking landscape, creating new revenue opportunities and driving efficiency gains. Digital banking platforms allow banks to reach a wider customer base and offer a broader range of services at a lower cost. Online and mobile banking channels reduce the need for physical branches, lowering operating expenses and improving customer convenience. Data analytics plays a crucial role in enhancing risk management, improving customer service, and identifying new revenue opportunities. Banks leverage data analytics to personalize products and services, detect fraudulent activities, and optimize pricing strategies. Fintech collaborations are becoming increasingly common, with banks partnering with fintech companies to leverage their innovative technologies and expand their service offerings. These partnerships can lead to the development of new products and services, such as mobile payment solutions and peer-to-peer lending platforms.

In addition to these primary sources of revenue, banks also generate profits from various other activities, such as insurance sales, real estate management, and custodial services. These ancillary activities contribute to a bank's overall profitability and diversify its revenue streams. However, banks must operate within a complex regulatory environment designed to ensure financial stability and protect consumers. Regulations such as capital requirements, liquidity standards, and consumer protection laws impose constraints on banks' activities and affect their profitability. Maintaining compliance with these regulations requires significant resources and expertise.

Ultimately, a bank's profitability depends on its ability to effectively manage risk, control costs, and adapt to changing market conditions. A well-diversified revenue stream, coupled with a strong risk management framework and a focus on customer service, is essential for long-term success in the banking industry. Banks must continuously innovate and adapt to remain competitive in an increasingly dynamic and challenging environment. Furthermore, ethical considerations and a commitment to responsible lending practices are crucial for maintaining public trust and ensuring the long-term sustainability of the banking system. By understanding the multifaceted ways in which banks generate revenue, we gain a deeper appreciation for their role in the global economy and the challenges they face in navigating the complexities of modern finance.