The question of "How to make money order at a post office? Where to start?" highlights a fundamental misunderstanding. Post offices are institutions designed for financial transactions like sending money orders, not for generating wealth or investment returns. Instead of seeking to make money orders, the focus should be on strategically using them within a broader financial plan. Money orders offer a secure and traceable way to send funds, particularly when dealing with individuals or businesses who don’t accept personal checks or digital payments. However, they are not inherently a tool for wealth creation. Let’s address the underlying question – how to grow your finances and manage risk effectively, while understanding the practical role a money order might occasionally play.

The journey toward financial well-being begins with a clear understanding of your current financial situation. This necessitates a comprehensive assessment of your income, expenses, assets, and liabilities. Creating a detailed budget is paramount. Meticulously track where your money goes each month. This process will reveal spending patterns, identify areas where you can cut back, and ultimately free up capital for investment. Many budgeting apps and software programs can streamline this process, offering visual representations of your spending habits and helping you stay on track. Don't underestimate the power of seemingly small, consistent savings; they accumulate significantly over time.

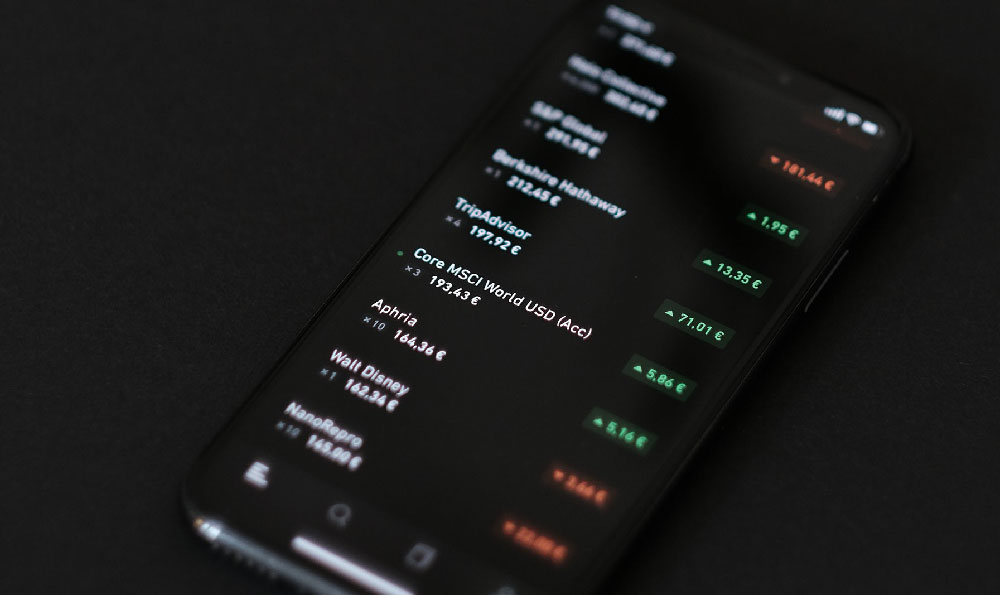

Once you have a firm grasp of your finances and have established a budget that allows for consistent savings, you can begin exploring various investment options. The key here is diversification. Putting all your eggs in one basket, be it a single stock, a specific cryptocurrency, or even just one type of real estate, significantly increases your risk. A well-diversified portfolio spreads your investments across different asset classes, mitigating potential losses if one particular investment underperforms. Consider a mix of stocks, bonds, mutual funds, exchange-traded funds (ETFs), and even real estate, tailoring the allocation to your risk tolerance and investment timeframe.

The stock market, while offering the potential for substantial returns, also carries inherent risks. Researching individual companies and understanding their financial performance is crucial before investing in their stock. Consider factors like their revenue growth, profitability, debt levels, and competitive landscape. Alternatively, you can opt for index funds or ETFs, which passively track a specific market index like the S&P 500. These offer instant diversification and typically have lower expense ratios than actively managed mutual funds. Remember, past performance is not indicative of future results.

Bonds, generally considered less risky than stocks, represent debt instruments issued by corporations or governments. They pay a fixed interest rate over a specified period, providing a more predictable income stream. Bonds can add stability to a portfolio, especially during periods of market volatility. Government bonds are typically considered the safest, while corporate bonds offer higher yields but also carry a higher risk of default.

Real estate offers another avenue for potential wealth creation, but requires significant capital and comes with its own set of challenges. Investing in rental properties can generate passive income, but also entails responsibilities like property management, tenant screening, and maintenance. Real estate investment trusts (REITs) offer a more accessible way to invest in real estate without directly owning physical properties.

Cryptocurrencies, like Bitcoin and Ethereum, have gained significant popularity in recent years, offering the potential for high returns but also carrying extremely high risks. The cryptocurrency market is notoriously volatile and susceptible to sudden price swings. If you choose to invest in cryptocurrencies, allocate only a small percentage of your portfolio that you are prepared to lose entirely. Thorough research and understanding of the underlying technology are essential. Avoid investing based on hype or fear of missing out (FOMO). Always prioritize security and store your cryptocurrencies in a secure wallet.

Before making any investment decisions, it's crucial to define your investment goals and risk tolerance. Are you saving for retirement, a down payment on a house, or simply seeking to grow your wealth over time? Your goals will influence the type of investments you choose and the level of risk you are willing to take. A younger investor with a longer time horizon can typically afford to take on more risk than an older investor approaching retirement.

Risk management is paramount in any investment strategy. Never invest more than you can afford to lose. Diversify your portfolio across different asset classes to mitigate risk. Rebalance your portfolio periodically to maintain your desired asset allocation. Stay informed about market trends and economic conditions, but avoid making impulsive decisions based on short-term fluctuations. Don't fall prey to scams or get-rich-quick schemes. If an investment opportunity sounds too good to be true, it probably is. Seek advice from a qualified financial advisor before making any major investment decisions.

Now, regarding the practical use of money orders within this framework: While money orders don't directly generate income, they can be a convenient tool for making payments related to your investments or financial obligations. For example, you might use a money order to pay rent on a rental property, settle a debt with an individual who doesn't accept other forms of payment, or even contribute to certain investment accounts. However, remember that using money orders incurs fees. Consider alternative payment methods like bank transfers, online bill pay, or certified checks if they are more cost-effective and readily available.

In conclusion, while post offices facilitate the use of money orders for financial transactions, they are not a means of generating wealth. Building financial security requires a holistic approach encompassing budgeting, saving, investing, and risk management. A well-diversified investment portfolio, tailored to your individual goals and risk tolerance, is the foundation of long-term financial success. Use money orders judiciously as a tool for facilitating payments when other options are unavailable, but focus primarily on building a robust and diversified investment strategy to achieve your financial aspirations. Continuous learning, disciplined execution, and a long-term perspective are essential for navigating the complexities of the financial markets and achieving lasting financial well-being.