Okay, I'm ready. Here's an article based on the title "How Much Can You Make Day Trading, and Is It Worth It?," focusing on providing comprehensive information, avoiding bullet points and numbered lists, and steering clear of phrases like "firstly" or "secondly." I will write it in English.

The allure of day trading, the practice of buying and selling financial instruments within the same trading day, hoping to profit from small price fluctuations, is undeniable. Images of individuals making substantial sums from the comfort of their homes, fueled by little more than a laptop and unwavering nerve, flood social media and entice countless hopefuls to try their hand at this fast-paced, high-stakes game. But the reality of day trading is often far removed from these glamorous portrayals, and the question of how much one can actually make, and whether it's truly "worth it," requires a much more nuanced exploration.

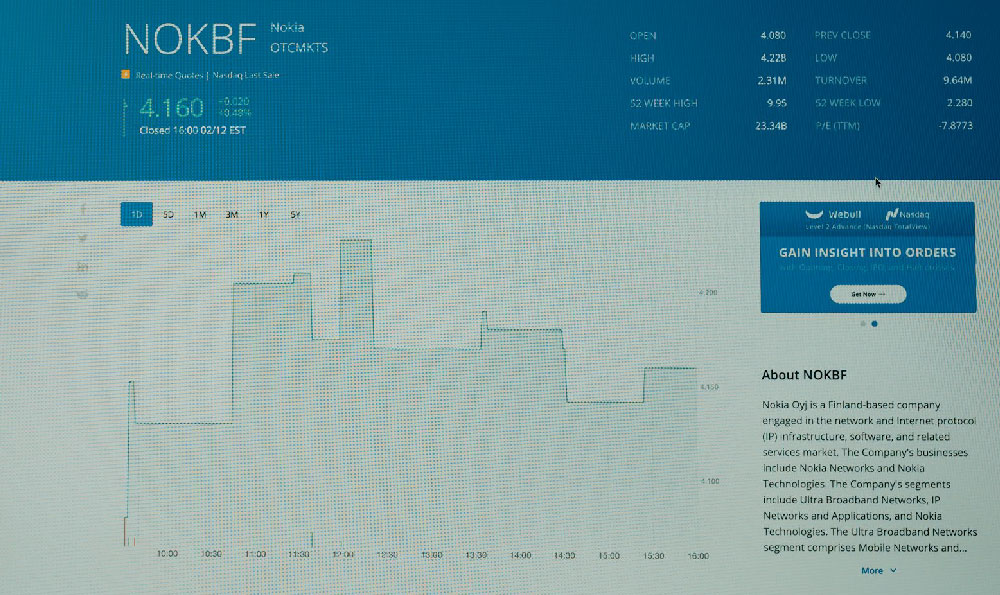

The potential income in day trading is, in theory, unlimited. The market presents opportunities every single day, and skilled traders who can accurately predict short-term price movements can capitalize on these opportunities. Some day traders focus on stocks, others on futures, options, foreign exchange (forex), or even cryptocurrencies. Each market has its own unique characteristics and potential for profitability, but also its own inherent risks. Consider a scenario: a skilled trader, leveraging their capital effectively and making consistent, informed decisions, might achieve a daily profit of, say, 1% of their trading account. This might sound modest, but compounded daily over weeks and months, the returns could become substantial. However, achieving such consistent profitability is exceptionally difficult.

One of the biggest hurdles to profitability in day trading is the inherent volatility of the markets. Prices fluctuate constantly, influenced by a myriad of factors including economic news, political events, company announcements, and even just shifts in investor sentiment. While volatility creates opportunities for profit, it also dramatically increases the risk of losses. A single piece of unexpected news can send prices plummeting, wiping out a trader's profits in a matter of minutes, or even triggering margin calls that force them to liquidate their positions at a loss.

Furthermore, the learning curve for day trading is incredibly steep. It requires a deep understanding of technical analysis, which involves studying price charts and using indicators to identify patterns and predict future price movements. It also demands a solid grasp of fundamental analysis, which involves evaluating the underlying financial health of companies or the macroeconomic factors that influence currency values. Beyond technical and fundamental knowledge, successful day traders possess a certain level of psychological discipline. They must be able to control their emotions, resist the urge to chase losses, and stick to their trading plan even when things are not going their way. Fear and greed are the enemies of rational decision-making in the market, and those who cannot manage their emotions are likely to make impulsive and ultimately costly mistakes.

The regulatory landscape surrounding day trading also plays a significant role. In many jurisdictions, day traders are subject to specific rules and regulations, including minimum capital requirements and restrictions on leverage. Leverage, which allows traders to control larger positions with a smaller amount of capital, can amplify both profits and losses. While it can be tempting to use high leverage to maximize potential gains, it also significantly increases the risk of ruin. Furthermore, transaction costs, including commissions and fees, can eat into profits, especially for those who make frequent trades. Choosing a broker with competitive fees and a reliable trading platform is crucial for day trading success.

It's also important to acknowledge the time commitment involved. Day trading is not a passive income stream. It requires constant monitoring of the markets, analyzing price charts, and executing trades. Successful day traders often spend hours each day researching and preparing for the trading session, and then spend several more hours actively trading. This can be a demanding and stressful lifestyle, and it's not suitable for everyone. Many initially attracted by the idea of freedom and flexibility find themselves chained to their screens, constantly worried about the next market move.

So, is day trading "worth it"? The answer, unfortunately, is that it depends entirely on the individual. For a small percentage of people with the right skills, temperament, and capital, day trading can be a lucrative and rewarding career. These individuals are often highly disciplined, risk-averse, and possess a deep understanding of the markets. However, for the vast majority of people who attempt it, day trading is a quick route to financial loss. Numerous studies have shown that the overwhelming majority of day traders lose money, often substantial amounts.

Before even considering day trading, prospective traders should carefully assess their financial situation and risk tolerance. They should only risk capital that they can afford to lose, and they should be prepared to invest a significant amount of time and effort into learning the ropes. It's also wise to start small, trading with a demo account or a very small amount of real money, to gain experience and test their strategies before risking larger sums. Education is key. Consider taking courses, reading books, and learning from experienced traders. There are many resources available online, but be wary of those that promise quick riches or guaranteed profits.

Ultimately, the decision of whether or not to pursue day trading is a personal one. It's important to be realistic about the challenges and risks involved, and to avoid being swayed by unrealistic expectations or marketing hype. Day trading is not a get-rich-quick scheme. It's a serious and demanding profession that requires skill, discipline, and a lot of hard work. Those who approach it with a clear understanding of these factors are more likely to succeed, while those who approach it with unrealistic expectations are likely to be disappointed. And remember, there are many other legitimate and potentially more stable ways to invest and grow your wealth. Diversification, long-term investing, and seeking advice from qualified financial professionals are often better strategies for the average investor.