The world of cryptocurrency and digital assets has evolved in remarkable ways since its inception, and understanding the financial dynamics within this space is crucial for anyone looking to engage with it. While the term "average salary" might seem out of place in the context of virtual currencies, it's worth delving into how the investment landscape of this industry has shifted over the years, and how individuals can navigate it with foresight and caution.

When considering virtual currency investments, it's essential to recognize that the market is characterized by high volatility and rapid technological advancements. This means that while some traders and investors may boast substantial returns, others could face significant losses. The role of the investor in this ecosystem is not just about acquiring assets; it's about developing a strategic approach that balances risk and reward. Understanding industry trends, like the development of blockchain technology, is vital. Technological innovation often drives market valuations, and being aware of these trends allows investors to anticipate potential growth opportunities.

However, forecasting the future of virtual currency investments remains a complex task. Unlike traditional financial markets, the virtual currency space is influenced by a myriad of factors, including regulatory changes, market sentiment, and technological breakthroughs. For instance, the introduction of new protocols or the widespread adoption of cryptocurrency could shift the market dynamics drastically. The key to navigating this complexity lies in conducting thorough research and analysis.

Investors who wish to mitigate risks should focus on diversifying their portfolios. Diversification is a fundamental principle in investment strategy, helping to spread risk across different assets and reduce potential losses. By allocating investments across a range of cryptocurrencies, investors can achieve a more balanced approach, which is particularly important given the unpredictable nature of this market.

Moreover, staying informed about regulatory developments is crucial for long-term success. As governments around the world enact policies that govern the use and trading of virtual currencies, these regulations can significantly impact the market. For example, new laws may create opportunities for certain cryptocurrencies or restrict their use in others. Understanding these regulatory changes allows investors to adjust their strategies accordingly and avoid potential legal issues.

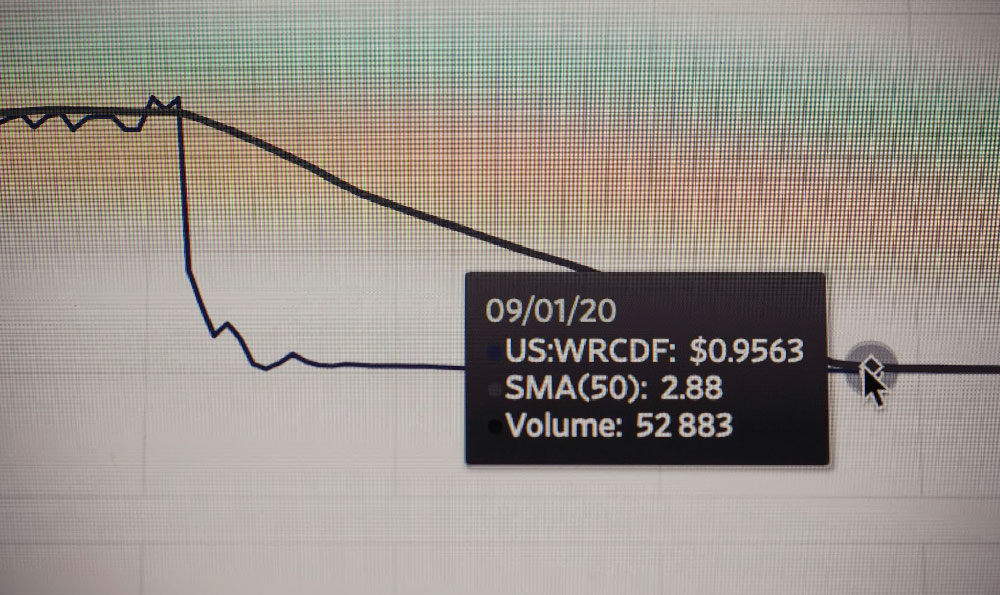

In addition, developing a strong understanding of the technical aspects of virtual currencies is important for making informed decisions. Technical analysis, which involves evaluating market trends and indicators, can help investors identify entry and exit points. However, it's essential to remember that no single strategy guarantees success, and investors should remain flexible and responsive to market changes.

Another aspect to consider is the need for continuous learning and adaptation. The virtual currency market is constantly evolving, and investors must be prepared to learn new skills and stay updated with the latest developments. This includes understanding the different types of cryptocurrencies, their underlying technologies, and their potential applications.

Finally, it's important to emphasize the need for a long-term perspective when investing in virtual currencies. While the market may experience short-term fluctuations, a long-term strategy can help investors capitalize on the overall growth of the industry. By focusing on fundamental analysis and understanding the value proposition of different assets, investors can make more informed decisions.

In conclusion, the virtual currency market presents a unique opportunity for financial growth, but it also requires careful consideration and strategic planning. By understanding the industry trends, utilizing technical analysis, and developing a long-term perspective, investors can navigate this complex space with confidence. It's important to remember that the key to success lies in continuous learning, risk management, and adaptability. Through these efforts, individuals can not only protect their investments but also position themselves for long-term financial success in the ever-evolving world of cryptocurrency.