Teachers, often unsung heroes of our society, dedicate their lives to shaping young minds and fostering future generations. However, the reality is that many teachers face financial constraints, making it challenging to achieve their own financial goals and secure a comfortable future. While the intrinsic rewards of teaching are immense, supplementing their income is a crucial aspect of ensuring financial well-being and allowing them to focus wholeheartedly on their profession. Diversifying income streams and making strategic investments can provide teachers with the financial security they deserve.

One avenue to explore is leveraging existing skills and expertise to generate additional income. Teachers possess a wealth of knowledge and a knack for explaining complex concepts in an accessible manner. This makes them ideally suited for tutoring, both in-person and online. Platforms like TutorMe, Chegg Tutors, and Skooli connect tutors with students needing assistance in various subjects. By offering personalized tutoring sessions, teachers can earn a significant supplementary income while continuing to utilize their pedagogical skills. Furthermore, creating and selling educational resources online, such as lesson plans, worksheets, and interactive activities, can generate passive income. Platforms like Teachers Pay Teachers provide a marketplace for educators to share and monetize their original materials, reaching a wide audience of fellow educators and parents.

Another viable option is to pursue freelance writing or editing opportunities. Teachers are typically strong communicators with excellent writing skills. Many websites and organizations need content writers and editors, and teachers can leverage their expertise to produce high-quality articles, blog posts, or marketing materials. Platforms like Upwork and Fiverr connect freelancers with clients seeking writing and editing services. The flexibility of freelance work allows teachers to manage their time effectively and earn income outside of their regular teaching hours.

Venturing into the realm of online courses and workshops can also prove to be a lucrative endeavor. Teachers can create and sell online courses on platforms like Udemy, Coursera, or Teachable, focusing on topics they are passionate about or areas where they possess specialized knowledge. These courses can cover a wide range of subjects, from academic topics to creative hobbies, appealing to a diverse audience of learners. Live workshops or webinars can also be offered, providing real-time instruction and interaction with students. The scalability of online courses and workshops allows teachers to reach a global audience and generate substantial income.

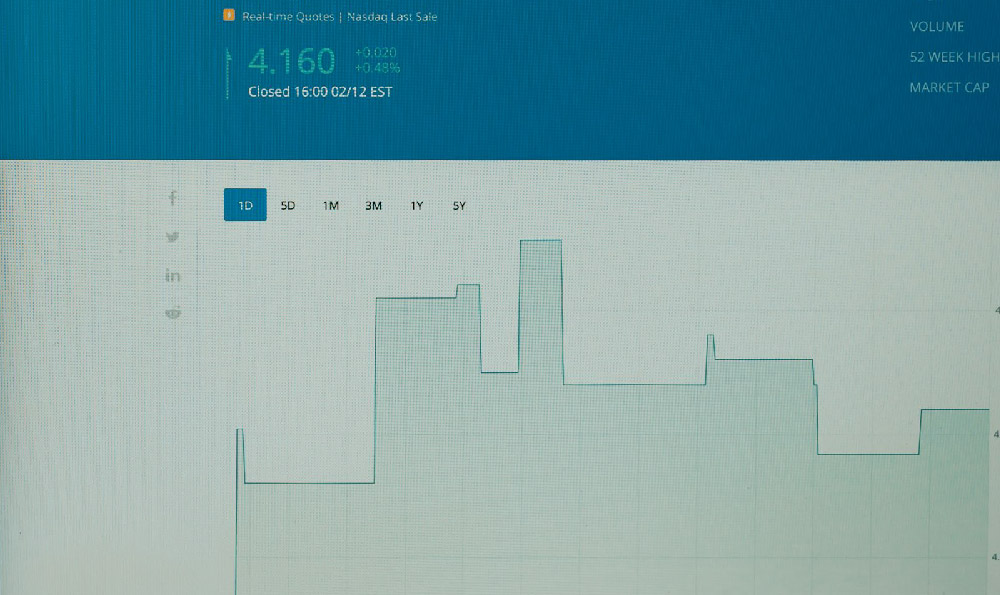

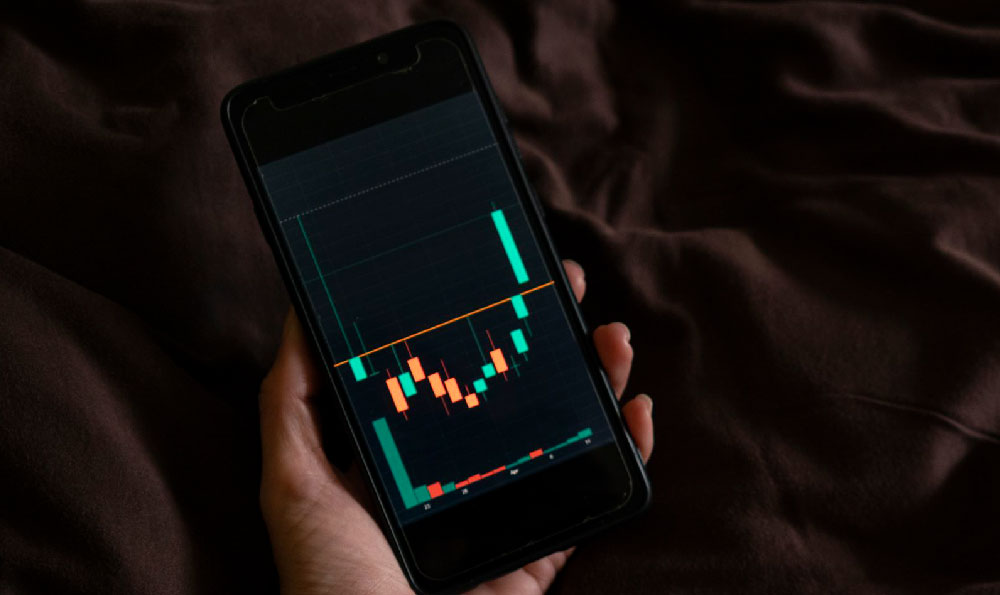

Beyond leveraging existing skills, investing wisely is crucial for long-term financial growth. While the stock market can be intimidating, it offers significant potential for wealth accumulation over time. A diversified investment portfolio, consisting of stocks, bonds, and mutual funds, can help teachers achieve their financial goals while mitigating risk. Investing in index funds or exchange-traded funds (ETFs) can provide broad market exposure at a low cost. However, it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions. Understanding one's risk tolerance and investment horizon is essential for creating a suitable investment strategy.

Real estate investment can also be a valuable addition to a teacher's portfolio. Purchasing a rental property can generate passive income and provide long-term appreciation potential. However, real estate investment requires careful planning and due diligence. Factors such as location, property condition, and rental market conditions should be thoroughly considered before making a purchase. Managing rental properties can be time-consuming, so it is essential to either hire a property manager or dedicate sufficient time to handle tenant interactions, maintenance, and repairs.

Considering the evolving landscape of finance, exploring the world of cryptocurrencies and decentralized finance (DeFi) can present opportunities for high returns, but it also comes with substantial risks. Before investing in cryptocurrencies, it is essential to thoroughly understand the underlying technology, market dynamics, and regulatory environment. Investing only a small percentage of one's portfolio in well-established cryptocurrencies like Bitcoin or Ethereum can provide exposure to this emerging asset class without jeopardizing financial stability. Participating in DeFi protocols, such as staking or yield farming, can potentially generate passive income, but it requires careful risk management and a deep understanding of the associated smart contracts. Due to the inherent volatility and complexity of the cryptocurrency market, it is crucial to exercise caution and seek advice from experienced cryptocurrency investors or financial advisors.

Budgeting and financial planning are fundamental to achieving financial success. Teachers should create a budget that tracks their income and expenses, identifying areas where they can save money. Setting financial goals, such as saving for retirement, purchasing a home, or paying off debt, can provide motivation and direction. Automating savings contributions can ensure that funds are regularly allocated towards these goals. Regularly reviewing and adjusting the budget as needed can help teachers stay on track and achieve their financial objectives.

Teachers should also prioritize debt management. High-interest debt, such as credit card debt, can significantly impede financial progress. Creating a debt repayment plan and prioritizing the repayment of high-interest debts can free up more funds for savings and investments. Consolidating debt into a lower-interest loan can also be a beneficial strategy. Avoiding unnecessary debt and practicing responsible credit card usage are essential for maintaining a healthy financial profile.

Finally, continuous learning and professional development are crucial for both enhancing teaching skills and exploring new income-generating opportunities. Teachers should seek out opportunities to expand their knowledge and expertise, attending workshops, conferences, or online courses related to their field. Developing new skills can open doors to new career paths or freelance opportunities. Staying abreast of the latest trends in education and technology can also help teachers adapt to the changing demands of the profession and remain competitive in the job market.

In conclusion, teachers can significantly increase their earnings by diversifying their income streams, making strategic investments, and practicing sound financial management. By leveraging their existing skills, exploring new opportunities, and prioritizing financial planning, teachers can achieve financial security and create a comfortable future for themselves and their families. While the path to financial freedom may require effort and dedication, the rewards of achieving financial well-being are well worth the investment.