Money Market Accounts have long been a staple in the financial world, offering a balance between safety and moderate returns. For investors seeking to grow their capital while preserving liquidity, understanding the interest rate dynamics of these accounts is crucial. The potential earnings from a money market account depend on several factors, including prevailing economic conditions, the institution's policies, and the investor's strategy. This article explores the intricacies of money market account interest rates, shedding light on how much one can realistically earn and the considerations that should guide such decisions.

At its core, a money market account functions as a type of savings account that typically allows for limited check-writing privileges and provides higher interest rates compared to traditional savings accounts. The return on investment is often quoted as an Annual Percentage Yield (APY), which includes the effect of compounding interest. However, the actual rate can vary significantly depending on the financial institution and the current market environment. In recent years, global central banks have maintained low interest rates to stimulate economic growth, which has directly impacted the APYs offered on money market accounts. Investors should be aware that while these accounts are relatively safe, the returns may not keep pace with inflation, potentially eroding the real value of their savings over time.

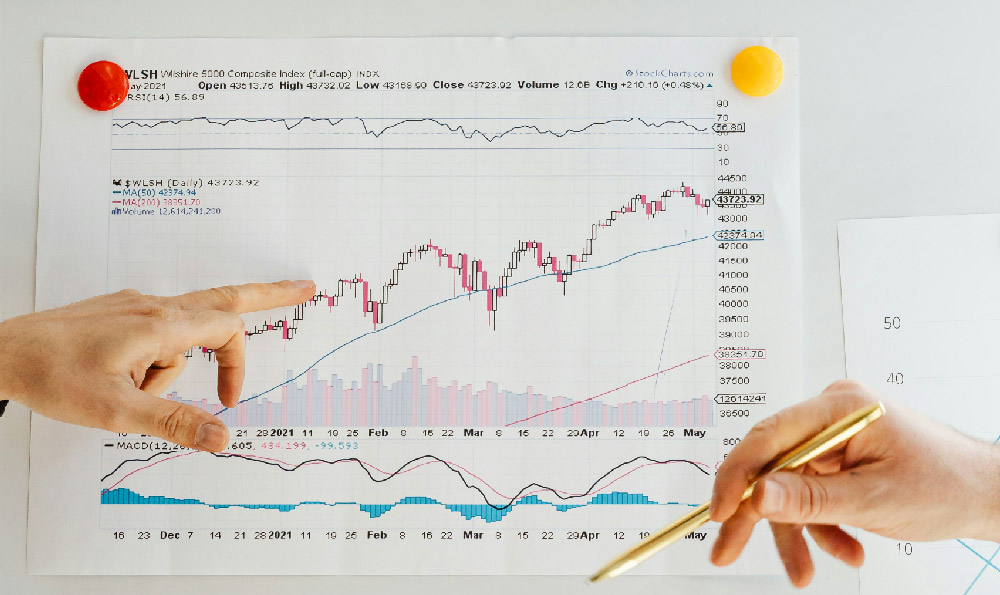

One of the key determinants of money market account interest rates is the Federal Funds Rate, which is the interest rate at which commercial banks lend reserve balances to each other overnight. When this rate increases, it typically leads to higher interest rates across the financial sector, including money market accounts. Conversely, during periods of economic downturn or low inflation, the Federal Funds Rate may remain low or even decrease, resulting in lower returns for investors. Understanding this relationship between macroeconomic indicators and money market rates can help investors anticipate changes and adjust their portfolios accordingly. For instance, if the Federal Funds Rate is expected to rise, it may be prudent to consider other investment vehicles with higher potential returns, even if they carry more risk.

Another important aspect is the role of the institution in setting interest rates. Each bank or credit union has its own policy regarding the rates it offers, influenced by factors such as its funding costs, competition, and the services it provides to customers. Some institutions may offer higher APYs as an incentive to attract more deposits, but these often come with minimum balance requirements or fees for exceeding certain transaction limits. It is essential for investors to carefully review these terms and conditions to ensure they are maximizing their returns without incurring unnecessary costs. For example, a bank may offer a slightly higher interest rate on a money market account that requires a minimum balance of $1,000, but failing to meet this threshold could result in a lower rate or even loss of interest.

Comparing money market accounts to other investment options is another critical step in determining potential earnings. While these accounts are safer than stocks or cryptocurrencies, they may offer lower returns compared to high-yield savings accounts or certificates of deposit (CDs). Additionally, in the realm of alternative investments, crypto assets have gained traction for their volatile yet potentially high returns. However, the risks associated with crypto investments—such as market fluctuations and regulatory uncertainty—make them unsuitable for all investors. A money market account serves as a more stable option for those prioritizing capital preservation, though its returns may not be as competitive as other riskier assets. Investors should evaluate their financial goals, risk tolerance, and time horizon to determine the optimal allocation between different types of investments.

To maximize returns, investors should consider diversifying their assets. While a money market account provides liquidity and safety, combining it with other investment strategies can lead to better overall performance. For example, allocating a portion of funds to short-term treasury bills or high-quality corporate bonds may offer higher yields while maintaining a low level of risk. However, it is imperative to balance these opportunities with prudent risk management. Investors must avoid overexposure to any single asset class, ensuring their portfolio is resilient against market fluctuations and economic downturns. In this regard, a money market account can serve as a valuable component of a diversified investment strategy, especially for those looking to park emergency funds or short-term savings.

The future of money market account interest rates is influenced by a complex interplay of economic factors. As central banks adjust their monetary policies in response to inflationary pressures or economic slowdowns, the rates offered on these accounts will fluctuate accordingly. Investors should remain vigilant and monitor economic indicators such as GDP growth, unemployment rates, and inflation data to make informed decisions. Additionally, technological advancements in the financial sector, including the rise of digital banks and automated investment platforms, may influence how money market accounts are structured and managed, potentially offering more competitive rates and enhanced features.

In conclusion, the potential earnings from a money market account are shaped by a combination of macroeconomic conditions, institutional policies, and individual investment strategies. While these accounts provide a secure and liquid option for capital preservation, investors must remain mindful of their financial goals and risk tolerance. By understanding the factors that influence interest rates, comparing different investment options, and managing risks effectively, investors can optimize their returns and build a more resilient financial portfolio.