Cronos (CRO), the native token of the Crypto.com chain, has been making waves in the cryptocurrency market. Evaluating its potential as a worthwhile investment demands a comprehensive understanding of its ecosystem, market position, and the broader forces shaping the crypto landscape. Making a "smart bet" isn't about chasing quick profits; it's about making informed decisions based on thorough research and a clear understanding of risk.

The foundational element of any cryptocurrency's success lies in its underlying technology and the utility it provides. Cronos operates as a decentralized, open-source blockchain built on the Cosmos SDK. This choice is significant. The Cosmos SDK is designed for interoperability, allowing Cronos to communicate and transact seamlessly with other blockchains within the Cosmos ecosystem and beyond. This interoperability is a crucial factor in the long-term viability of any blockchain project, as it facilitates the flow of assets and information, expanding the network's reach and potential applications. Cronos's design specifically targets the DeFi (Decentralized Finance) sector and aims to provide a scalable and secure environment for developers to build decentralized applications (dApps). This focus is strategically sound, as DeFi represents a significant growth area within the crypto space, with potential to disrupt traditional financial systems.

The Crypto.com exchange, which initially launched CRO, provides substantial utility and support for the token. CRO is integral to the Crypto.com ecosystem, offering various benefits to users who stake or use it within the platform. These benefits typically include reduced trading fees, increased staking rewards, and access to exclusive features. This integration creates a demand for CRO, as users are incentivized to hold and use it. However, it's crucial to recognize that CRO's price is intrinsically linked to the performance and reputation of Crypto.com. Any negative events affecting the exchange, such as security breaches or regulatory issues, could have a detrimental impact on the value of CRO. Diversification of holding is a key principle in risk management.

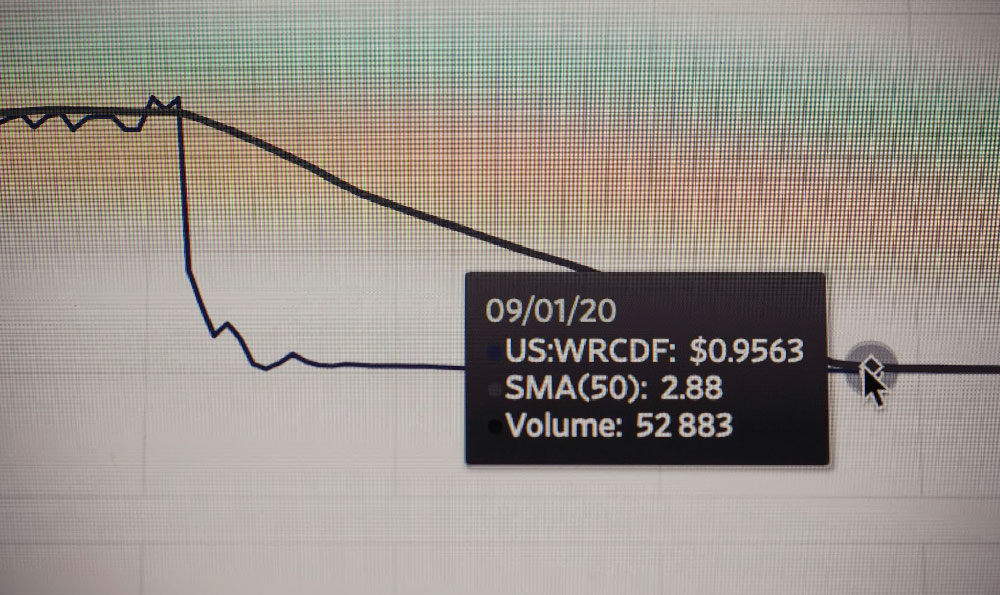

To assess the investment potential of CRO, analyzing its market performance and adoption rates is essential. CRO has experienced significant price volatility, which is characteristic of many cryptocurrencies. Price swings can be influenced by a multitude of factors, including overall market sentiment, news events, technological advancements, and regulatory changes. Before investing, potential investors should thoroughly research the historical price movements of CRO and understand the factors that have contributed to its fluctuations. Analyzing trading volumes and market capitalization can also provide valuable insights into the liquidity and overall health of the CRO market. A healthy project generally shows consistent growth in these metrics.

Beyond market data, understanding the competitive landscape is paramount. The cryptocurrency market is intensely competitive, with numerous projects vying for user adoption and market share. Cronos faces competition from other Layer-1 blockchains like Ethereum, Solana, and Avalanche, each offering its own unique features and advantages. To succeed, Cronos must differentiate itself by providing superior performance, lower fees, or more innovative applications. Its strong ties to the Crypto.com exchange provide an advantage in terms of user acquisition, but it also needs to attract developers and users from outside the Crypto.com ecosystem to achieve sustainable growth.

The regulatory environment surrounding cryptocurrencies is constantly evolving, and these changes can significantly impact the value and adoption of CRO. Governments around the world are grappling with how to regulate cryptocurrencies, and regulations can vary widely from country to country. Uncertainty surrounding regulations can create volatility in the market, and unfavorable regulations could potentially restrict the use of CRO or even lead to its delisting from exchanges. Staying informed about regulatory developments in key jurisdictions is therefore critical for anyone considering investing in CRO.

Technical analysis can be a useful tool for identifying potential entry and exit points for CRO investments. Technical analysts use charts and indicators to identify patterns in price movements and predict future price trends. Common technical indicators include moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence). However, it's important to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis and risk management techniques. Relying solely on technical analysis can be misleading and lead to poor investment decisions.

Protecting your investment in CRO requires implementing robust security measures. Cryptocurrencies are susceptible to hacking and theft, so it's crucial to store your CRO in a secure wallet and protect your private keys. Hardware wallets, which store your private keys offline, are generally considered the most secure option. Enabling two-factor authentication (2FA) on your exchange accounts and using strong, unique passwords can also help to prevent unauthorized access to your funds. Be wary of phishing scams and never share your private keys with anyone.

In conclusion, whether Cronos (CRO) is a worthwhile investment and a "smart bet" depends on individual circumstances, risk tolerance, and investment goals. CRO possesses several appealing characteristics, including its strong ecosystem integration with the Crypto.com exchange, its interoperability with the Cosmos network, and its focus on the DeFi sector. However, it also faces challenges, including intense competition from other blockchains, regulatory uncertainty, and the inherent volatility of the cryptocurrency market. A well-informed investor should conduct thorough research, assess their own risk appetite, and consider all these factors before making an investment decision. Investing only what you can afford to lose and diversifying your portfolio are essential principles to follow. Remember, no investment is guaranteed to be profitable, and prudent risk management is key to protecting your capital.