The financial landscape of digital content creation is intricate, entailing not only the production of engaging material but also the intricate web of monetization strategies that enable creators to turn their online presence into a sustainable income. As content creators like Ryan's World amass vast followings, the question of their earnings becomes a focal point for both aspiring creators and investors seeking insights. Understanding the mechanisms behind YouTube revenue generation is essential, yet it remains a complex endeavor due to the layered factors influencing income. This analysis delves into the multifaceted strategies available to digital content creators, the challenges in accurately estimating earnings, and the broader implications of such financial success in today's evolving digital economy.

YouTube's monetization framework is primarily driven by three pillars: ad revenue, sponsored content, and subscription-based models. Ad revenue, a cornerstone for most YouTubers, operates through the platform's algorithm-driven advertising system, which assigns ads to videos based on viewer demographics and content alignment. Creators earn a share of this revenue, typically ranging from $3 to $10 per 1,000 views (CPM), though the actual rate fluctuates with factors like ad type, audience engagement, and the geographical distribution of viewers. Sponsored content, on the other hand, provides a more direct avenue for earning, with brands paying creators for integrating their products or services into video content. The valuation of such partnerships often hinges on metrics like audience size, viewer retention, and the perceived value of the creator's brand. Subscription-based models, particularly through YouTube Premium, offer another revenue stream, with viewers paying for exclusive access to content, thereby creating a steady income for creators.

However, estimating the exact earnings of high-profile channels like Ryan's World is fraught with challenges. The primary obstacle lies in the opacity of YouTube's revenue reporting, which does not publicly disclose detailed financial figures unless the creator chooses to share them. Additionally, the fluctuating nature of ad rates and the variability in sponsorship deals complicate precise calculations. For instance, while a video might generate a predictable CPM based on its audience size, sudden changes in advertiser demand or shifts in viewer behavior can drastically alter income projections. Furthermore, the influence of external factors such as macroeconomic conditions, content policy changes, and competitive dynamics adds another layer of unpredictability.

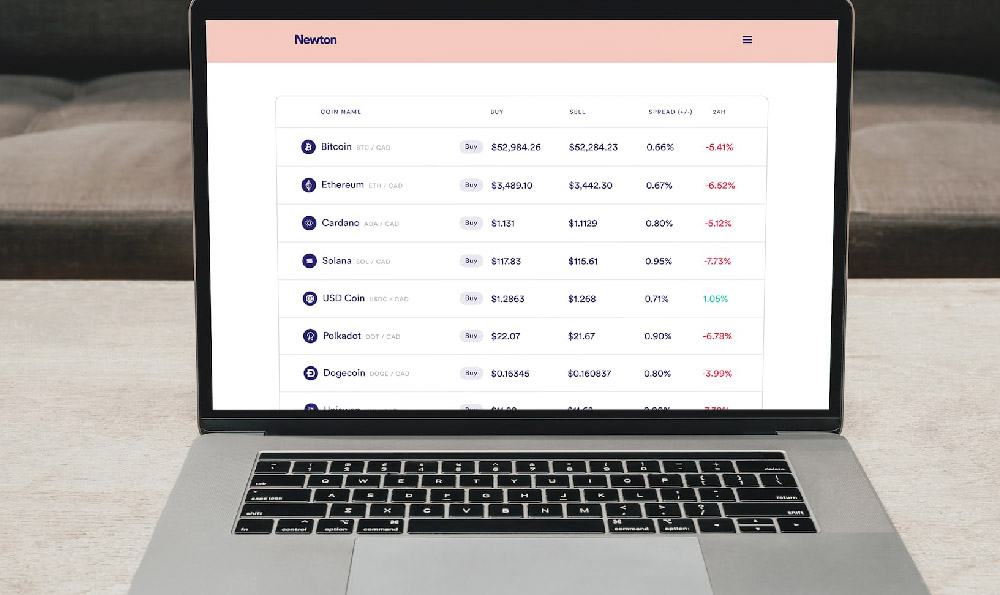

The broader implications of such financial success extend beyond mere numbers, influencing both the creator's brand and the surrounding ecosystem. High earnings often correlate with increased brand equity, enabling creators to command higher rates for sponsorships and advertising. This, in turn, can stimulate further growth, as evidenced by the case of Ryan's World, which has cultivated a massive following over the years. Nevertheless, the volatility of the digital market necessitates a balanced approach, where creators must navigate the fine line between reinvesting profits and maintaining financial stability. This duality is particularly relevant when considering potential investment avenues, such as allocating proceeds into virtual currencies or other diversified financial instruments.

In the context of virtual currency investments, the principles governing YouTube monetization can offer valuable parallels. Both domains require a strategic approach, where understanding market dynamics, risk management, and long-term growth is paramount. While YouTube creators rely on a combination of viewer engagement and advertising partnerships, investors must evaluate the intrinsic value of digital assets and the broader economic trends affecting their price. The lesson here is clear: whether generating income through content creation or investing in virtual currencies, success is contingent upon informed decision-making and a commitment to learning.

Moreover, the interplay between YouTube earnings and virtual currency investments highlights the importance of diversification. Creators like Ryan's World, who have established a robust revenue model, may find opportunities to expand their financial portfolio by exploring alternative investments. Diversification mitigates risk, ensuring that reliance on a single income source does not jeopardize overall financial health. This approach aligns with the investment philosophy of balancing high-growth opportunities with stability, a strategy that is equally applicable to content creation and virtual currency markets.

The future of YouTube revenue generation is also influenced by technological advancements and shifting consumer preferences. As artificial intelligence and machine learning enhance ad targeting capabilities, the potential for higher earnings increases. However, these advancements also present challenges, such as the need to optimize content for algorithmic preferences while maintaining authenticity with the audience. Similarly, the rise of virtual currencies and decentralized technologies is reshaping the financial landscape, offering new opportunities for investment and wealth creation. Creators must remain adaptable, leveraging these innovations to navigate the complexities of the digital economy.

In conclusion, the financial success of content creators like Ryan's World underscores the importance of strategic monetization, audience engagement, and adaptability. While accurate income estimation remains a challenge, informed decisions and diversified financial planning can help navigate the uncertainties of the digital market. Whether through traditional YouTube monetization or exploring virtual currency investments, the key to sustained success lies in a deep understanding of the underlying mechanics and a disciplined approach to risk management. As the digital economy continues to evolve, the ability to remain agile and informed will be crucial for both creators and investors seeking to capitalize on emerging opportunities.