Day trading, the practice of buying and selling financial instruments within a single trading day, has long captured the imagination of investors seeking quick profits. While the allure of rapid wealth creation is undeniable, the reality of day trading earnings is far more nuanced. The amount one can earn through this activity varies widely, influenced by factors such as market conditions, trading strategies, time commitment, risk tolerance, and emotional discipline. It is a field that demands both intellectual rigor and psychological resilience, as the potential for gain is matched only by the possibility of substantial loss.

To begin with, it is essential to recognize that day trading is not a guaranteed path to riches. Many individuals enter this arena with the hope of transforming small capital into significant returns, only to face the harsh truth that consistent profitability is rare. The markets are inherently volatile, and prices can fluctuate dramatically within short timeframes. Successful day traders are those who can navigate this unpredictability, leveraging both technical analysis and market sentiment to make informed decisions. However, the sheer volume of data and the rapid pace of trading require a level of focus and expertise that not everyone possesses.

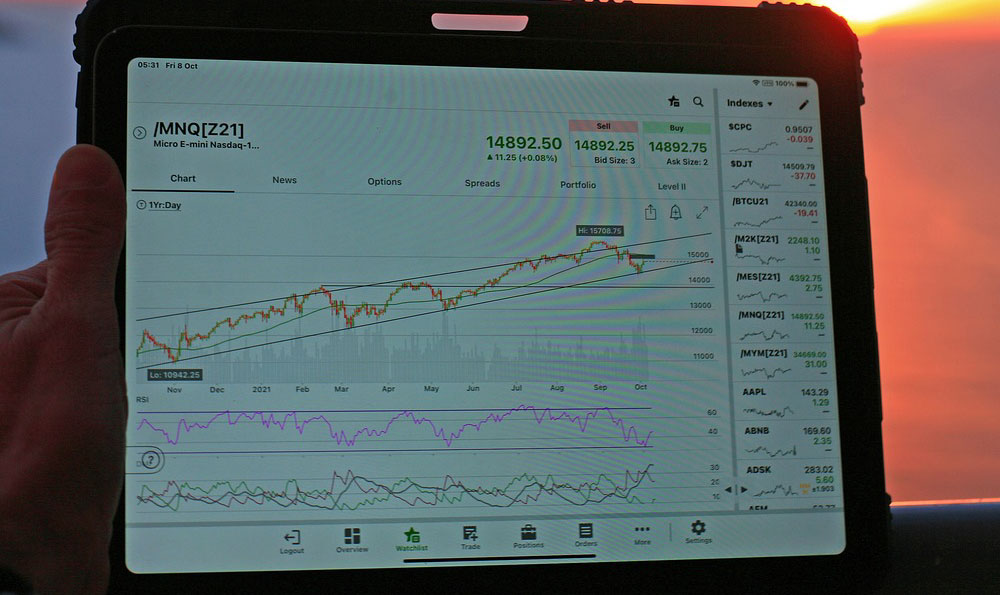

The earnings potential of day trading is also contingent upon the type of financial instruments being traded. Stocks, forex, commodities, and indices each present unique opportunities and risks. For example, trading stocks on major exchanges like the NYSE or NASDAQ often involves higher liquidity and transparency compared to emerging markets, which may offer greater volatility. Forex trading, on the other hand, operates 24 hours a day, providing perpetual opportunities for traders but also exposing them to the challenges of managing time zones and global economic events. The choice of instrument can dictate the frequency of trades, the size of profit targets, and the overall risk profile of the trader's strategy.

Another critical factor is the trader's approach and methodology. Some day traders rely on algorithmic strategies, employing complex mathematical models to identify patterns and execute trades at optimal times. Others may adopt discretionary methods, basing decisions on real-time market data and personal judgment. The effectiveness of these approaches depends on the trader's ability to adapt to changing market conditions, whether it's a sudden shift in geopolitical tensions, a surge in investor sentiment, or a technical breakout. Moreover, the use of leverage—a common practice in day trading—can amplify both gains and losses, making it a double-edged sword that requires careful management.

The time and effort invested in day trading also play a pivotal role in determining earnings. Unlike long-term investing, which allows for passive wealth accumulation, day trading demands constant vigilance. Traders must monitor market movements, analyze charts, and react swiftly to new information. This intensive work schedule can lead to significant stress and exhaustion, which may impair decision-making. Additionally, the learning curve is steep; mastering the intricacies of market mechanics, risk assessment, and psychological control often takes years of practice and experience. Those who underestimate the time required to develop a successful strategy are likely to face repeated setbacks.

Risk management is perhaps the most crucial aspect of day trading. The financial sector is riddled with uncertainties, and no strategy is immune to failure. A disciplined trader will implement strict rules to limit exposure, such as setting stop-loss orders and adhering to position sizing guidelines. These measures help protect capital and ensure that losses remain manageable. However, even with meticulous planning, the unpredictable nature of markets can result in unexpected outcomes. The key lies in balancing risk and reward, understanding that volatility is a constant companion in this field.

Psychological factors cannot be overlooked in evaluating day trading earnings. Emotions like fear and greed can cloud judgment, leading to impulsive decisions that deviate from a trader's strategy. For instance, a trader might hold onto a losing position in the hope of a rebound, only to face even greater losses. Conversely, the fear of missing out on a potential profit can prompt excessive trading, increasing the likelihood of errors. Developing emotional discipline, patience, and a clear mindset is essential for long-term success in day trading.

It is also important to consider the broader context of financial markets. Global events, economic indicators, and corporate earnings reports all have the potential to send markets into turmoil. Traders must stay informed about these developments, as they can create opportunities for profit or trigger significant losses. For example, a bullish market trend may offer favorable conditions for long positions, while a bearish environment may favor short-selling strategies. The ability to anticipate and adapt to these macroeconomic shifts is a valuable skill that separates successful traders from the rest.

Ultimately, the earnings from day trading are not linear or predictable. Some traders may achieve substantial returns within a short period, while others may struggle to break even. The market is a game of probabilities, and success is often the result of a combination of skill, strategy, and luck. For those who are serious about pursuing day trading, it is crucial to approach it with realistic expectations, continuous learning, and a commitment to disciplined practices. The path to profitability is not guaranteed, but with the right mindset and approach, it is a viable avenue for those willing to invest the time and effort.