CoinPro, like many automated trading assistants flooding the market, promises to simplify cryptocurrency trading and maximize profits for its users. The allure is understandable: the crypto market is notoriously volatile and complex, requiring constant vigilance and a deep understanding of technical analysis. A tool that claims to automate this process, making it accessible to even novice traders, is undoubtedly appealing. However, the critical questions remain: does CoinPro actually work, and is it a worthwhile investment?

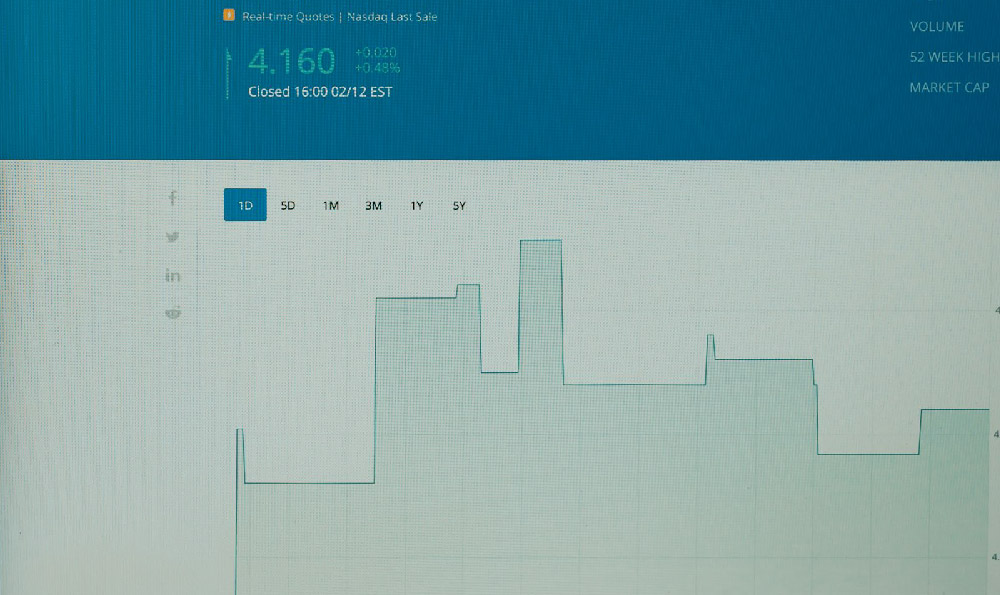

To answer these questions, we need to dissect CoinPro’s functionalities and scrutinize its claims. Most automated trading assistants operate on pre-programmed algorithms, often incorporating machine learning to adapt to market fluctuations. These algorithms analyze vast amounts of data, including price movements, trading volume, and news sentiment, to identify potentially profitable trading opportunities. CoinPro likely functions similarly, leveraging technical indicators like moving averages, relative strength index (RSI), and Fibonacci retracements to generate buy and sell signals.

The effectiveness of such a system hinges on the quality of its algorithms and the data it analyzes. If the algorithms are poorly designed or based on flawed assumptions, the results will be predictably disappointing. Likewise, if the data feed is unreliable or the system struggles to interpret market signals accurately, the resulting trades will likely be suboptimal.

CoinPro’s marketing materials likely highlight success stories and boast impressive returns. However, it's crucial to approach these claims with healthy skepticism. Testimonials can be easily fabricated, and past performance is never a guarantee of future results, especially in the highly unpredictable crypto market. Any legitimate trading platform will prominently display a disclaimer emphasizing the risks involved and the possibility of losing money. Lack of such a disclaimer should be a major red flag.

Beyond the algorithm's performance, the platform's user interface and overall usability are also important considerations. A clunky, confusing interface can negate any potential benefits the underlying technology offers. A good trading assistant should be intuitive and easy to navigate, even for users with limited experience. Features like customizable risk management settings, clear reporting of trading activity, and prompt customer support are essential for a positive user experience.

One of the biggest concerns surrounding automated trading assistants is the level of control users relinquish. While the promise of hands-free trading is tempting, it also means entrusting your funds to a black box. It's essential to understand how the system works and to be able to override its decisions if necessary. A responsible trading assistant should provide users with the ability to set stop-loss orders, adjust risk parameters, and manually intervene in trades.

Furthermore, the security of the platform is paramount. Cryptocurrency exchanges and trading platforms are frequent targets for hackers. CoinPro must employ robust security measures to protect users' funds and personal information. This includes two-factor authentication, encryption of sensitive data, and regular security audits. It's wise to research the platform's security track record before entrusting it with your assets.

The cost of using CoinPro is another crucial factor. Most automated trading assistants charge either a subscription fee or a commission on profitable trades. It's important to carefully evaluate the cost structure and determine whether it aligns with your trading strategy and risk tolerance. Some platforms also offer free trials, which can be a valuable way to test the system's performance before committing to a paid subscription.

So, does CoinPro really work? The answer is complex and nuanced. While some users may experience positive results, others may be disappointed. The effectiveness of the platform depends on a variety of factors, including the quality of its algorithms, the accuracy of its data, the user's trading strategy, and the overall market conditions.

Is CoinPro worth it? Again, there's no simple answer. For experienced traders who understand the risks and limitations of automated trading, CoinPro might be a valuable tool for augmenting their existing strategies. However, for novice traders who are looking for a quick and easy way to make money, CoinPro is likely to be a disappointment. The crypto market is inherently risky, and there are no guaranteed profits.

Before investing in CoinPro, it's essential to conduct thorough research, read reviews from reputable sources, and understand the platform's terms and conditions. Be wary of exaggerated claims and promises of guaranteed returns. Remember that the most effective investment strategy involves a combination of knowledge, discipline, and careful risk management. Consider starting with a demo account or a small amount of capital to test the system before committing a significant portion of your portfolio. Ultimately, the decision of whether or not to use CoinPro is a personal one that should be based on your individual circumstances and risk tolerance.

In conclusion, CoinPro, like all automated trading assistants, presents both opportunities and risks. It can potentially streamline trading and automate certain processes, but it's crucial to approach it with caution and a healthy dose of skepticism. Thorough research, careful evaluation of the platform's features and security measures, and a clear understanding of the risks involved are essential before investing in CoinPro. Remember that there is no magic bullet for achieving financial success in the crypto market, and responsible investing always involves a combination of knowledge, discipline, and careful risk management. The key is to treat such tools as aids, not replacements for your own financial acumen and careful decision-making.