Cash App, the brainchild of Block, Inc. (formerly Square, Inc.), has revolutionized the way people manage their finances, particularly among younger demographics. Its user-friendly interface and diverse functionalities, from peer-to-peer payments to stock and Bitcoin trading, have propelled it to become a major player in the fintech landscape. But how does this seemingly "free" app generate revenue and sustain its operations? Let's delve into the various revenue streams that contribute to Cash App's profitability.

Transaction Fees: The Foundation of Revenue

While Cash App boasts free standard peer-to-peer transfers, it levies fees for expedited transfers and business transactions. When users opt for instant transfers, which allow funds to be available immediately, they incur a small fee, typically around 1.5% of the transaction amount. This convenience fee adds up significantly, especially given the sheer volume of daily transactions processed through the platform.

Business accounts, designed for vendors and small businesses, are also subject to transaction fees. When a business receives payments through Cash App, it's charged a fee, usually 2.75% per transaction. This provides a convenient and cost-effective payment processing solution for businesses, while simultaneously generating a steady revenue stream for Cash App. The scale of these transactions is massive, contributing substantially to overall revenue.

Cash Card: A Debit Card with a Twist

The Cash Card, a customizable debit card linked to the user's Cash App balance, represents another significant revenue source. While using the card for standard purchases doesn't incur direct fees, Cash App earns interchange fees from merchants every time the card is used. Interchange fees are a percentage of the transaction amount paid by the merchant's bank to the card issuer (in this case, Cash App) and the payment network (like Visa or Mastercard).

Furthermore, Cash App offers "Boosts," which are instant discounts or rewards on purchases made with the Cash Card at specific merchants. While these boosts appear to benefit the user, they often represent partnerships with these merchants. Cash App may receive a commission or a promotional fee from the merchant for featuring their brand and driving sales through the Boost program. This symbiotic relationship benefits both Cash App and its partnered merchants.

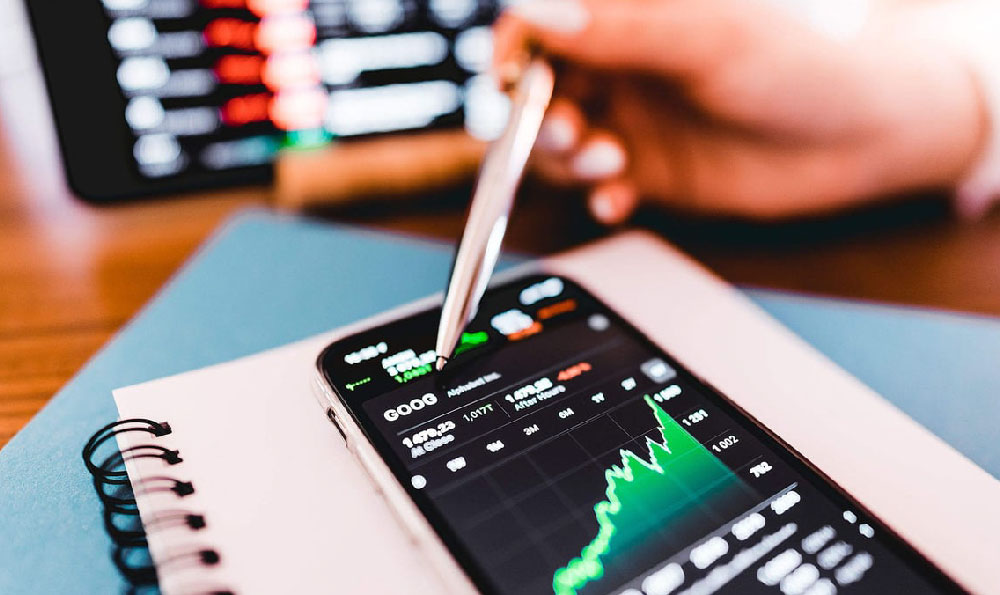

Bitcoin and Stock Trading: Tapping into Investment Trends

Cash App's foray into the world of investments has proven to be a lucrative venture. The app allows users to buy and sell Bitcoin and fractional shares of stocks directly from their Cash App balance. While Cash App advertises low or no commission fees, it generates revenue through spreads. A spread is the difference between the buying and selling price of an asset. Cash App effectively buys Bitcoin and stocks at one price and sells them to users at a slightly higher price, pocketing the difference as profit.

Given the increasing popularity of cryptocurrencies and stock market investing, especially among younger and digitally-savvy individuals, this feature has become a major revenue driver for Cash App. The accessibility and ease of use of the platform make it attractive to novice investors, further fueling transaction volumes and contributing to the bottom line. The risk associated with these investments is borne by the user, while Cash App profits from the trading activity.

Interest Income: Leveraging User Balances

Cash App holds a substantial amount of funds in its user accounts. While these funds are ultimately owned by the users, Cash App can leverage them to generate interest income. The company can invest a portion of these aggregated funds in short-term, low-risk securities, earning interest on the holdings. This interest income, while perhaps less prominent than transaction fees or trading revenue, still contributes to the overall profitability of the platform. The specifics of these investment strategies are often not publicly disclosed, but it represents a standard practice for financial institutions holding large sums of customer deposits.

Other Potential Revenue Streams: Future Growth Opportunities

Beyond the established revenue streams, Cash App is actively exploring new avenues for generating income. This includes potential partnerships with other financial institutions, offering premium services such as tax preparation or lending products, and expanding its ecosystem to include more business-focused tools and solutions. The app's vast user base and established brand recognition provide a solid foundation for future growth and diversification.

Risk Management and Compliance: The Unsung Costs

It's important to acknowledge the costs associated with running a platform like Cash App. Maintaining security, ensuring compliance with regulations, and mitigating fraud are essential but expensive endeavors. Cash App invests heavily in these areas to protect its users and maintain its reputation. These costs are often offset by the revenue generated from various streams, allowing the company to maintain profitability while providing a safe and reliable platform.

In conclusion, Cash App's profitability stems from a multi-faceted approach, leveraging transaction fees, interchange fees, spreads on investments, and interest income. By providing a user-friendly platform for peer-to-peer payments, investing, and everyday spending, Cash App has successfully monetized its services and established itself as a leading player in the fintech industry. While the app may appear "free" on the surface, it generates substantial revenue through a variety of innovative and strategic mechanisms. Understanding these revenue streams provides a clearer picture of Cash App's business model and its long-term sustainability. The continuous innovation and adaptation to evolving consumer needs will undoubtedly shape its future profitability and its position in the competitive financial landscape.